NS

NSEquities gain whilst DXY & Bonds hold flat ahead of Fed Chair Powell - Newsquawk US Market Open

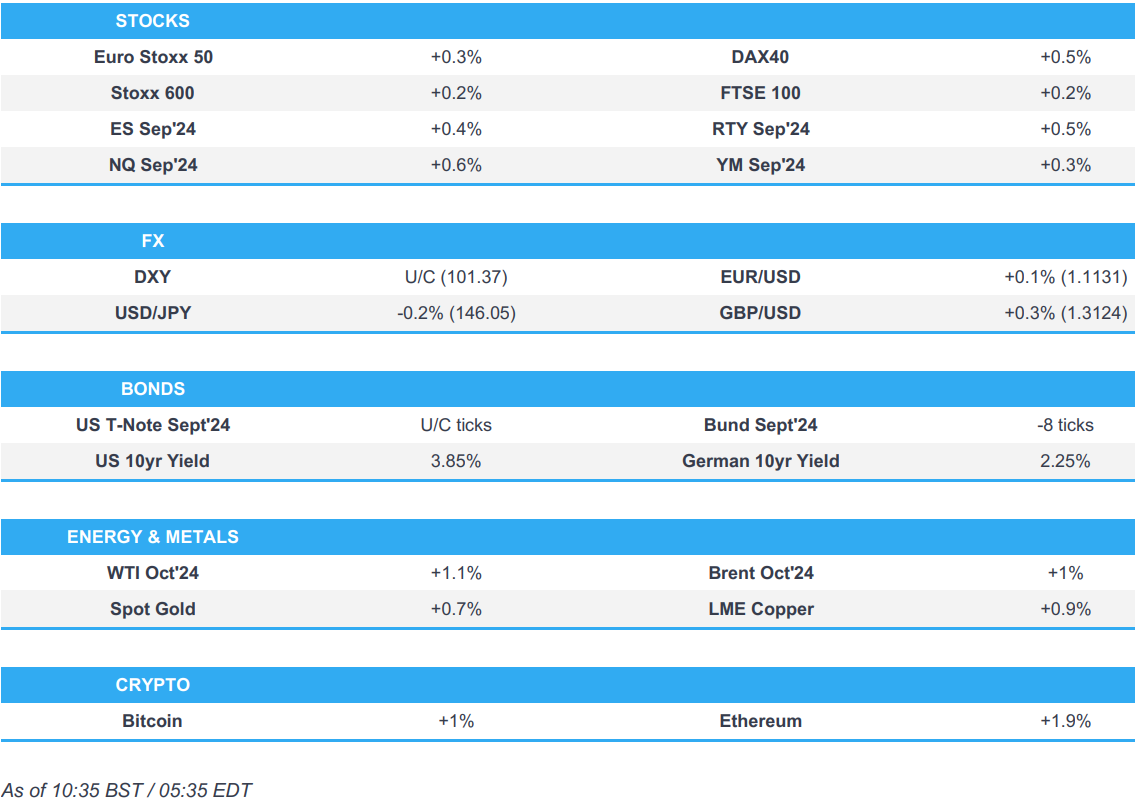

- European bourses are modestly firmer, whilst US futures gain to a slightly higher degree

- Dollar is flat, Antipodeans leads, JPY initially propped up by BoJ Governor Ueda, but has since pared

- Bonds are in a holding pattern ahead of Fed Chair Powell

- Crude is firmer and near session highs, XAU gains but is still below 2500, base metals in the green

- Looking ahead, Canadian Retail Sales, Jackson Hole Symposium, Speeches from Fed Chair Powell, Fed's Goolsbee & BoE’s Bailey

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx 600 (+0.2%) are generally firmer, having opened on a mostly flat footing. The complex picked up as the morning progressed; ahead Fed Chair Powell at 15:00 BST / 10:00 EDT.

- European sectors hold a slight positive bias, but with the breadth of the market fairly narrow. Banks top the pile, joined by Energy, whilst Tech lags slightly.

- US Equity Futures (ES +0.5%, NQ +0.6%, RTY +0.2%) are entirely in the green, paring back some of the hefty losses seen in the prior session.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is softer vs. peers by varying degrees. DXY is holding below the 101.50 mark in the run-up to Fed Chair Powell's appearance at the Jackson Hole Symposium.

- EUR is a touch firmer vs. the USD and steady on a 1.11 handle after briefly slipping to a 1.1098 low on Thursday. ECB speak today and the ECB's Consumer Expectations Survey have had little follow-through for the EUR.

- Cable is currently holding around Thursday's 1.3130 peak, which if breached would bring in the 2023 peak at 1.3142 into view.

- JPY is edging mild gains vs. the USD but ultimately remaining within Thursday's 144.84-146.52 parameters. Comments from BoJ Governor Ueda overnight brought on some appreciation of the JPY with the Governor very much leaving the door open for further rate hikes.

- Antipodeans are both a touch firmer vs. the USD. AUD/USD appears to be in consolidation mode for now after a recent run of gain.

- PBoC set USD/CNY mid-point at 7.1358 vs exp. 7.1480 (prev. 7.1228).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are in a holding pattern into Powell, unchanged within a narrow range around the 113-10 mark and at the low-end of Thursday's 113-05+ to 113-27 band. Ahead of Powell, benchmarks have generally come under some very modest pressure as crude picks up to incremental session highs.

- Bunds are very much contained and holding within Thursday's 134.11-135.08 range ahead of Fed Chair Powell. ECB SCE and commentary from Kazaks provided little impetus.

- Gilts are flat and around 99.50, waiting Powell and thereafter a text release from Bailey at 16:00BST (speech scheduled for 20:00BST).

- OATs await updates from how the meeting between French President Macron and the left-wing NFP alliance PM candidate goes.

- Click for a detailed summary

COMMODITIES

- Crude is firmer intraday despite a lack of pertinent catalysts this morning but in a continuation of the strength seen on Thurday. Brent October sits in a USD 77.03-77.64/bbl parameter.

- Firmer trade across precious metals following Thursday's session of losses, and with today's gains also facilitated by a softer Dollar and a weekend of potential geopolitical risks. Spot gold remains under USD 2,500/oz in a USD 2,484.41-2,497.61/oz parameter.

- A sea of green across base metals amid the broader optimism across markets coupled with a generally softer Dollar and a session of losses on Thursday.

- China's Industry Ministry revised steel production capacity replacement measures and stated that from today, all regions will suspend announcements of new steel production capacity replacement plans.

- Click for a detailed summary

NOTABLE DATA RECAP

- Swedish Unemployment Rate SA (Jul) 8.6% vs. Exp. 8.4% (Prev. 8.2%)

NOTABLE EUROPEAN HEADLINES

- ECB Consumer Expectations Survey (July): See inflation in next 12 months at 2.8% (prev. 2.8%); 3yrs ahead sees 2.4% (prev. 2.3%)

- ECB's Kazaks said EZ inflation is consistent with further gradual ECB rate cuts; assume two more rate cuts this year and there is no reason now not to follow through, according to Reuters.

- UK GfK Consumer Confidence (Aug) -13.0 vs. Exp. -12.0 (Prev. -13.0)

- UK's Ofgem says the energy price cap for October to December 2024 will rise 10% (exp. 9%) to GBP 1717 (prev. 1568) for a typical household

NOTABLE US HEADLINES

- Apple (AAPL) To offer more options for choosing default browser in the EU. Plans to create a dedicated space on iPhones for changing default apps. Says new features to be available later this year in EU. To allow deletion of apps such as camera, App Store, photos, and messages. (Newswires)

- Amazon (AMZN) Tenders reportedly show that state-linked Chinese entities use Amazon (AMZN) Cloud unit to access restricted AI chips and models including Nvidia (NVDA) chips banned from export to China, according to Reuters. (Reuters)

- PRIMER - FED CHAIR POWELL (15:00BST/10:00EDT): At the Jackson Hole economic symposium, traders will scrutinise Fed Chair Powell’s comments on the potential rate cut size. Markets expect a 25bps reduction at the September 18th confab, with some small chance of a 50bps cut, but that is ultimately likely to be resolved after the August jobs data (due September 6th), as the Fed maintains its data-dependent approach, with a focus shifting to balancing inflation control with employment stability. Powell might signal a preference for gradual easing and emphasise preventing unexpected labour market weakness, as many other Fed officials have recently. (full details on the headline feed)

GEOPOLITICS

MIDDLE EAST

- EU foreign policy chief Borrell said he discussed with the Iranian Foreign Minister the cessation of military cooperation with Russia and defusing regional tensions, according to Al Jazeera.

OTHER

- Ukrainian drone attempted to attack Kursk nuclear plant; the drone was shot down near the plant, via Tass citing sources

- Ukraine’s Air Force said it used a US-made GBU-39 bomb to strike a Russian military target in Russia's Kursk region.

- NATO air base in the German town of Geilenkirchen has raised its security level based on intelligence information indicating a potential threat, according to Reuters.

- China's Foreign Ministry said in China-Belarus joint communique that both sides support the peaceful settlement of conflicts, constructive bilateral dialogue among countries, and international cooperation based on mutual benefit and mutual respect.

CRYPTO

- Bitcoin is incrementally firmer and climbs past USD 61K, whilst Ethereum sees gains to a larger magnitude and holds above USD 2.6k.

APAC TRADE

- APAC stocks were ultimately mixed amid cautiousness as braced for a slew of global central bank rhetoric including Fed Chair Powell's speech at the Jackson Hole Symposium.

- ASX 200 was restricted amid notable weakness across the commodity-related sectors.

- Nikkei 225 swung between gains and losses after Japanese CPI printed mostly in line with expectations, while there was also a slew of commentary from BoJ Governor Ueda who stood by last month's BoJ rate hike.

- Hang Seng and Shanghai Comp. initially diverged with the former pressured by underperformance in NetEase and Baidu due to earnings disappointment, while the mainland was indecisive amid very few fresh catalysts.

NOTABLE HEADLINES

- BoJ Governor Ueda said concerns about a slowing US economy caused the recent market rout and they closely watching market moves with a sense of urgency as uncertainties remain, while there is no change to the stance that they would adjust the degree of monetary easing if the price outlook is likely to be achieved. Ueda said the July rate hike decision was based on their inflation forecast and the risk of inflation overshoot, as well as stated that the BoJ's policy path to a neutral interest rate remains highly uncertain but noted that Japan's short-term interest rate is still very low so if the economy performs well, the BoJ will adjust rates to levels deemed neutral to the economy. Ueda said they may conduct operations nimbly if there's a sharp rise in long-term yields. Says they removed the wording "continue accomodative environment" from the outlook report, as it was said to be interpreted as not increasing rates for the foreseeable future

- Japanese Finance Minister Suzuki said there is a potential risk of Japan's financial health deterioration from a rate hike as government debt is high and they cannot rule out the possibility of Japan's economy falling back into deflation. Furthermore, Suzuki said a weak yen has merits and demerits, while he cannot tell if a strong yen has bigger merits or demerits. Suzuki added the FX intervention in July was effective and intervention was conducted to respond to speculative moves and excessive volatility.

- Tenders showed that state-linked Chinese entities use Amazon's (AMZN) Cloud unit to access restricted AI chips and models including Nvidia (NVDA) chips banned from export to China, according to Reuters.

- China's Politburo is holding a meeting, via Xinhua, on developing western China. Must promote the upgrading of traditional industries. Strengthen security guarantees capabilities within key areas. Strengthen energy resource guarantees and the construction of clean energy guarantees. Must persist in building a strong sense of community for the nation, safeguarding unity and border stability.

- "China’s Ministry of Commerce met with automakers and industry associations...The meeting adds to a succession of events that clearly shows China is seriously studying calls of tariff rate hikes on imported large-engine cars, industry insiders said", GT.

DATA RECAP

- Japanese National CPI YY (Jul) 2.8% vs. Exp. 2.7% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Jul) 2.7% vs. Exp. 2.7% (Prev. 2.6%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jul) 1.9% vs. Exp. 1.9% (Prev. 2.2%)

- New Zealand Retail Sales Volumes QQ (Q2) -1.2% (Prev. 0.5%)

- New Zealand Retail Sales YY (Q2) -3.6% (Prev. -2.4%)