JPM Markets Desk: "Sentiment Is Turning Very Negative On The US Consumer"

Two weeks after bursting the AI bubble, JPM's truthy trading desk (not to be confused with the bank's flip-flopping sellside propaganda) has taken the hammer to the myth of a "resurgent" US consumer. Here is JPM consumer trader Brian Heavey with some truth bombs that will quickly make persona non grata to the Biden department of bullshit.

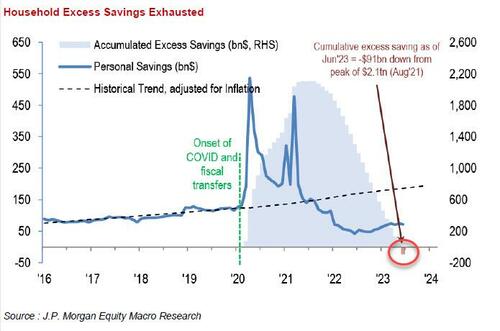

Sentiment is quickly turning very negative across retail/discretionary (seeing weakness across retail, casual diners, casinos etc). What's driving it? While the continued spike in crude is getting the most attention, we've anecdotally heard that data across the complex is beginning to roll as the Back-to-School tailwind fades (which drove a lot of the mgmt august optimism) and a renewed focus on the myriad of consumer headwinds: longer term impact of inflation/higher-for-longer rates, student debt repayment and consumer personal savings depletion.

While price action was more extreme yesterday, the bleed continues and we are seeing zero bid for discretionary.