The Next AI Trade

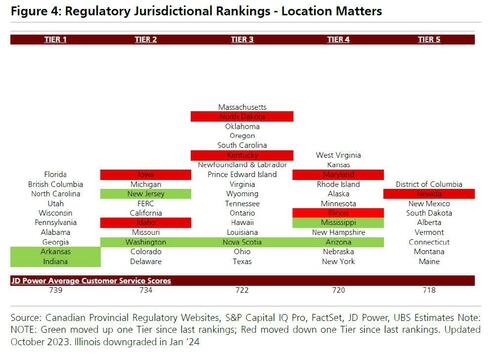

For all its trite thoughts and profound-yet-trivial musings, the latest annual letter from Warren Buffett contained a rather insightful segment, one which may prove to be apocryphal to US hopes of leading the AI revolution. Discussing the recent "earnings disappointment" at Berkshire's energy subsidiary, BHE (Berkshire Hathaway Energy) which generates over 30 gigawatts of power and is one of the largest US energy distributors, and lamenting the regulatory chaos across various blue states (most notably California), Buffett said that "when the dust settles, America’s power needs and the consequent capital expenditure will be staggering. I did not anticipate or even consider the adverse developments in regulatory returns and, along with Berkshire’s two partners at BHE, I made a costly mistake in not doing so."

The Omaha Billionaire is not the only one to raise the red flag about the coming electricity crisis.

In an op-ed titled just that, the WSJ editorial board writes that while Biden and the press "keep raising alarms about a climate crisis that his policies can’t do much about, in the meantime they’re ignoring how government climate policies are contributing to a looming electric-grid crisis that is more urgent and could be avoided." The oped then expands on Buffett's fatalistic ruminations:

These pages have been warning for years about an electric-power shortage. And now grid regulators and utilities are ramping up warnings. Projections for U.S. electricity demand growth over the next five years have doubled from a year ago. The major culprits: New artificial-intelligence data centers, federally subsidized manufacturing plants, and the government-driven electric-vehicle transition.

The bolded text above cuts rights to the punchline: it is indeed almost exclusive the upcoming surge in AI data centers (much more deails below) that is expected to place an unprecedented strain on the US power grid, so much so that the gating factor holding back US leadership in the global AI race will not be chips that power the AI chatbots, or the petabytes of free-flowing information that is so critical to teaching the AI Large Language Models how the real world, but rather old electrical poles and power lines.

Among the examples laid out in the WSJ oped of why the US is facing a looming electricity crisis are the following:

Georgia Power recently increased 17-fold its winter power demand forecast by 2031, citing growth in new industries such as EV and battery factories.

AEP Ohio says new data centers and Intel’s $20 billion planned chip plant will increase strain on the grid. Chip factories and data centers can consume 100 times more power than a typical industrial business.

PJM Interconnection, which operates the wholesale power market across 13 Midwest and Northeast states, this year doubled its 15-year annual forecast for demand growth. Its projected power demand in the region for 2029 has increased by about 10 gigawatts—about twice as much as New York City uses on a typical day.

And speaking of New York, the state is headed for an power shortage of its own as it shuts down nuclear and fossil-fuel power in favor of wind and solar. A new Micron chip factory in upstate New York is expected to require as much power by the 2040s as the states of New Hampshire and Vermont combined.

Let's back up: is electricity really the binding constraint for data centers? Yes, it is...

While many have expressed growing doubts about some or all of the unprecedented hyperbole attendant to the hottest trade of the past year, namely the unprecedented melt up in anything and everything to do with AI, whether it is Microsoft which earlier this year overtook AAPL as the world's most valuable company, or NVDA whose "picks and shovels" model has made it the world's most important (momentum-driven) stock, few have looked beyond the "nuts and bolts" limitations - or in this case chips and server racks - to this wonderful world-changing thesis (a thesis which if "successful" will leave 300 million unemployed, but we'll cross that particular revolutionary bridge when we come to it) few have considered the far more trivial constraints that a world whose electrical grid was built out in the 60s and 70s, could and would impose on this world-changing technology.

Well, it turns out that about a year after everyone "assumed" that the exponentially growing number of data centers could be powered infinitely with zero incremental costs and just the - pardon the pun - flick of a power switch, some are starting to realize that one of the AI derivative plays, namely the re-electrification of US (and global) power grid may be just as important, if not profitable, as the original AI trade.

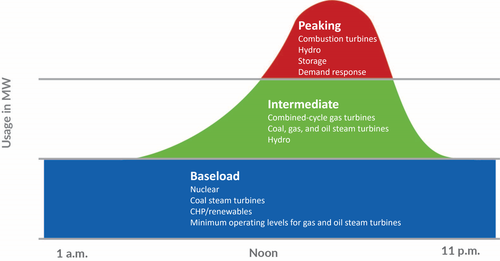

That's because data centers — like manufacturing plants — require reliable, steady power around the clock year-round, which wind and solar don’t provide.

Meanwhile, cutting edge chatbot providers and various other AI and hyperscaler businesses can’t afford to wait for batteries to become cost-effective, and building transmission lines to connect distant renewables to the grid typically takes 10 to 12 years. Because of these challenges, Obama Energy Secretary Ernest Moniz last week predicted that utilities will ultimately have to rely more on gas, coal and nuclear plants to support surging demand: “We’re not going to build 100 gigawatts of new renewables in a few years,” he said.

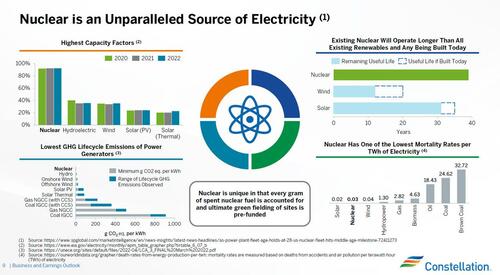

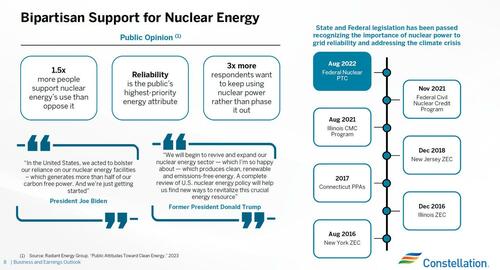

No kidding... what he really meant is that the US will have to unleash a new nuclear power plant renaissance (as previewed last week "In Historic Reversal, US To Restart A Shut Down Nuclear Power Plant For The First Time Ever") if it hopes to keep the AI rally going.

Some Basics: How much is the demand for power growing?

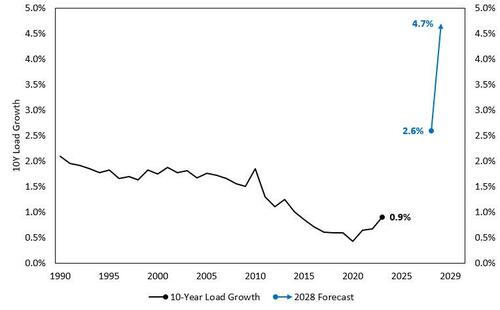

Electricity peak demand and energy growth rates are increasing in North America after being flat for years. Load growth had already electrification trends and electric vehicles, but annual peak demand growth was still only up 0.9%. With the increased focus on data centers, industrial facilities, and other near-term investments, this is likely to be an underestimate considering that in just one year (2023), the forecast of cumulative electricity growth over the next 5 years increased from 2.6% to 4.7% driven by major utilities further revising up their estimates.

To be sure, when looking at all the drivers of electricity demand growth, it is more than just AI-related:

Onshoring trends: tariffs, covid, and other shocks to distributed production networks have caused multinationals to re-evaluate their optimal supply chain structures and are feeling more confident in having closer geographical control over their operations. More manufacturing facilities in the US require more power.

Electrification of transportation and buildings: this ranges from using electric vehicles to electric heating and cooling.

Extreme weather is increasing at a higher frequency and is driving record peak demands.

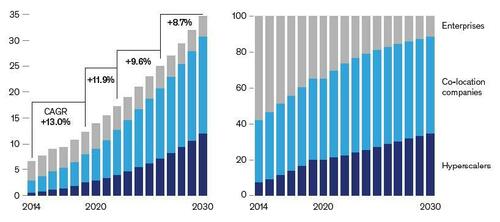

But the biggest swing variable is the also the most improtant one: Data center demand is forecast to grow by an average of 10% per year until 2030.

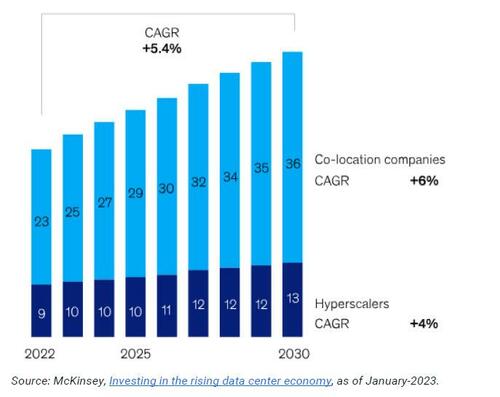

The chart below shows data center power consumption, by providers/enterprises in gigawatts (left) and in share percent (right).

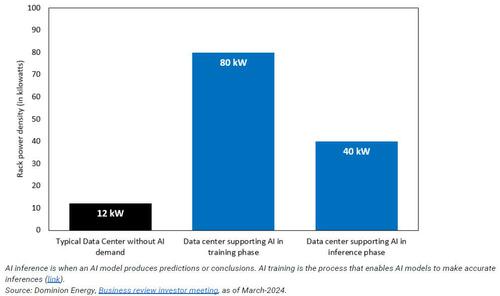

Turning just to the AI part of the equation, data centers - instrumental in enabling the AI boom - are the fastest growing consumer of power. The range of power consumption is wide: a data center supporting the AI training phase can consume up to 80 kW of power, data centers supporting AI in inference phase consume up to half of that, and those with no AI demand can consume up to 1/8th of that. As a result, in the absence of more efficient training and inference processes, further development of AI will lead to more consumption from data centers and increased demand for power. It is worth noting that data centers are changing their pricing models to include "power consumption" vs "per space consumption".

Looking ahead, according to an analysis from commercial real estate firm CBRE Group, electricity demand to power data centers is projected to increase by 13% to 15% compounded annually through 2030. Yet a shortage of power is already delaying new data centers by two to six years. It is also driving Big Tech companies into the energy business. Amazon this month struck a $650 million deal to buy a data center in Pennsylvania powered by an on-site 2.5 gigawatt nuclear plant.

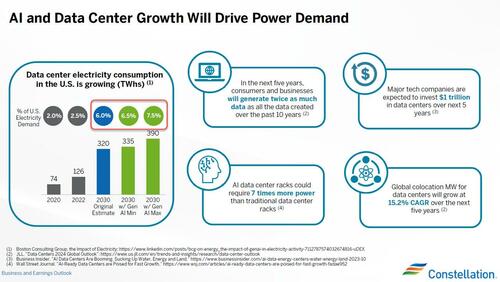

And while Democrats and Progressives may kick and scream, the only practical solution to the coming explosion in electricity demand is nuclear as the following two slides from the latest Constellation Energy earnings call make clear:

One thing is certain: not only will tech giants come up with elegant solutions to power their data centers, we are standing on the precipice of a historic spending boom to enable the AI industry. According to McKinsey, global spending on the construction of data centers is forecast to reach $49 billion by 2030, up from $37 billion this year

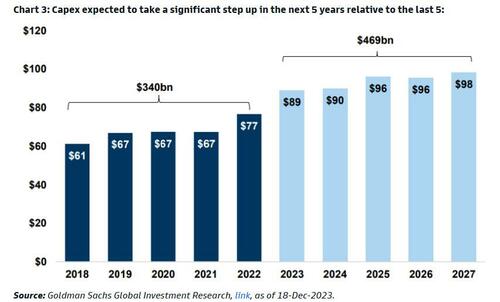

Meanwhile, total capex across the utility sector is "expected to take a significant step up in the next 5 years relative to the last 5" as Goldman wrote in its 2024 Utilities Outlook note (available to pro subs in the usual place).

Just to drive home how much of a paradigm shift we are talking about with the transition to data center electricity demand, here is Constellation Energy CEO Joseph Dominguez...

"Boston Consulting Group believes that AI and regular data center demand will grow to 7% of total electricity demand by 2030. To put this in context, this is the equivalent of the electricity used for lighting in every home business and factory across the United States. It's a huge amount of energy. Most traditional data centers that were built 10 years ago were 10 megawatts or less. Today, it's not uncommon to see 100-megawatt data centers. And with our clients, we're talking about data centers that approach 1,000 megawatts. And they require 24/7 power. This is something that doesn't get talked about enough in my opinion."

... and here are some observations from a recent Weekend Note from One River CIO Eric Peters:

“Everyday I’m surprised by how fast power consumption is growing,” said the entrepreneur. I was checking in. He had put this theme on my radar last June, when he said, “Take any application, add AI, and you need 7x-50x the compute power. AI is a black hole; it’ll suck money out of everything else and into its vortex. The arms race between industry giants is a 20 on a scale of 1-10.”

He had called for brownouts in the coming years for certain major metropolitan areas in the US. “This is bigger than I could have ever imagined."

“It makes you scratch your head and wonder how we ended up in this situation. How were the projections that far off,” said the Chairman of Georgia’s Public Service Commission. Industrial electricity demand in Georgia forecasted over the coming decade has jumped 17x in the blink of an eye. Each state has its own story. In 2019 the 9yr forecast for new electricity demand across the entire US was 256k gigawatt hours. In 2020 it dropped to 182k. In 2021 it jumped to 277k. In 2022 it fell to 221k. At of the end of 2023, it surged 150% to 564k.

Translation: nobody is ready for what is coming.

This is where it gets even more complicated: "Progressive" Politics

As it becomes clear just how staggering the power needs of AI-critical data centers will be, the attendant problems are also becoming all too clear, starting with an aged and dilapidated infrastructure. About 20 gigawatts of fossil-fuel power are scheduled to retire over the next two years—enough to power 15 million homes—including a large natural-gas plant in Massachusetts that serves as a crucial source of electricity in cold snaps. PJM’s external market monitor recently warned that up to 30% of the region’s installed capacity is at risk of retiring by 2030.

While some plants are naturally nearing the end of their useful life-spans, an onslaught of costly Democrat regulation is the bigger cause. A soon-to-be-finalized Environmental Protection Agency rule would require natural-gas plants to install expensive and unproven carbon capture technology.

The PJM report cites “the role of states and the federal government in subsidizing resources and in environmental regulation.” It added: “The simple fact is that the sources of new capacity that could fully replace the retiring capacity have not been clearly identified.” No wonder even a lifelong Democrat like Warren Buffett is suddenly raging at blue states for crippling the power sector with insurmountable red tape.

Meantime, adding bureaucratic insult to injury, the huge renewable subsidies in Biden's laughably misnamed "Inflation Reduction Act" make it harder for fossil-fuel and nuclear plants - the same plants that are absolutely critical for AI to receive steady, constant, unconditional and uninterrupted electricity - to compete in wholesale power markets. The cost of producing power from solar and wind is roughly the same as from natural gas. But IRA tax credits can offset up to 50% of the cost of renewable operators, badly skewing incentives toward producing plants which will end up being completely useless in just a few short years

Until then, however, baseload plants (primarily nuclear but also some coal steam) can’t turn a profit operating only when needed to back up renewables, so they are closing. This was the main culprit for Texas’s week-long power outage in February 2021 and the eastern U.S.’s rolling blackouts during Christmas 2022.

The media - the WSJ's op-ed concludes with grand snark - "will discover this problem eventually, though not this year if it might call into question Biden’s climate agenda. Perhaps they’ll notice when more blackouts arrive."

* * *

It goes without saying that any blackouts, let alone "more", are bad for electricity-gobbling data centers and the AI revolution... Very bad. Which is why they must be avoided, but - in simple terms - that means a lot of money has to be spent to make sure that the dilapidated, creaking, at places ancient power grid is capable of supporting the hyper-modern technological paradigm of AI that is supposed to send the world into a productivity euphoria.

And this is where the new investing opportunity comes in.

The Next AI Trade

Everyone has heard about buying MSFT, NVDA, and various other "AI ecosystem" stocks to get exposure to AI, but what about getting exposure to AI via the various derivative trades, such as infrastructure, electrification, power grid, and energy? After all, none other than Goldman's head of single-stock research Jim Covello warned a few weeks ago in his weekly Markets/Macro note (available to pro subscribers here) is that the core AI theme appears exhausted and that investors should start looking at alternatives as even the companies at the forefront of the AI revolution are seeking to "manage near-term expectations", to wit:

... while the AI infrastructure build is clearly alive and well (with investment opportunities that are now extending to the power grid), it is notable that several large AI players, including Microsoft and Google, seem to be making a concerted effort to manage near-term expectations about what AI is capable of today. Microsoft in particular seems to be focused on making sure the Street doesn’t get carried away with the current utility of its co-pilot offering. Eventually, there will need to be AI applications that replace meaningful high value workloads in order for AI to fulfill its promise. Some of the biggest and best positioned tech companies are doing their best to make sure the Street understands that it may be a bit ahead of itself on how far along the industry really is on having those applications ready. This isn’t lost on investors -- to quote Pete Callahan: “amidst an ongoing debate re: the long-term ‘impacts’ of A.I. on software, investors continue to be more comfortable expressing an A.I. view down the stack (basically anything ‘hard-tech / infra’ related where it doesn’t matter ‘who wins’ up the stack).”

Said otherwise, the easy money has been made, and now the market will increasingly reward those investment dollars that don't seek a quick return.

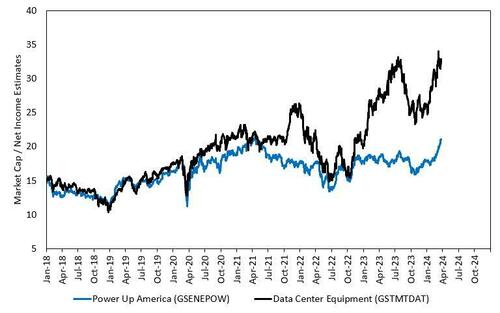

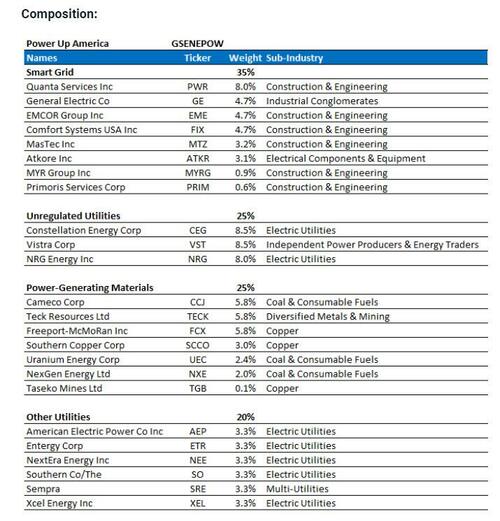

One place to find such an alternative investment opportunity is in what Goldman has dubbed its Power Up America theme (Bloomberg ticker GSENEPOW), which has rallied 21% year-to-date (and has been covered in more detail here for professional subscribers, Part 1 and Part 2); another place is the Data Center Equipment basket (Bloomberg ticker GSTMTDAT) which is up 22%. Meanwhile, Goldman's AI basket (BBG ticker GSTMTAIP) was up 32% in Q1 of last year, and those that assumed the theme would not continue the trend missed on another 45% of returns.

While we already discussed the primary drivers behind electricity demand growth above, which include i) Onshoring trends (tariffs, covid, and other shocks); ii) Electrification of transportation and buildings; iii) Extreme weather driving record peak demand; and iv) the biggest driver of all, data center demand, the best way to express the coming deluge in demand for electricity is by breaking up the Power-Up America theme into four categories:

30% Smart-grid infrastructure: the current US grid is expected to face risks with the rise of EVs, electrification of space heating and cooling, and fundamental changes in demand due to economic shifts and new sources of demand like data centers for AI, cryptocurrency mining, and more. In addition to that, the current grid faces external factors that add stress like extreme weather conditions.

25% Unregulated utilities are in states where the consumer is not required to opt-in for a single energy provider – this allows for a free energy market with no capped upside due to regulation. Deregulated states have wholesale markets where electricity and natural gas trade as commodities. Billing is also different, not only can supplier rates appear on a local utility bill, customers can elect to receive two bills: one from the supplier for energy supply and one from the utility for energy delivery.

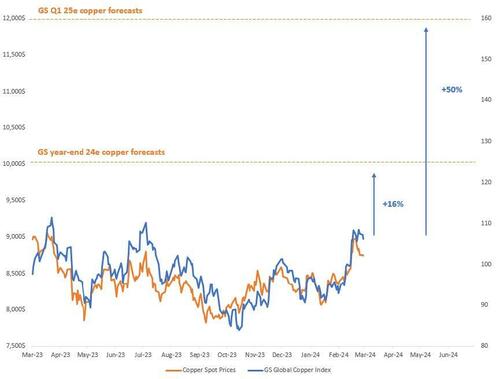

25% Power-generating raw materials are considered direct beneficiaries of growing power demand. Here, the primary focus on two categories: copper and uranium. We have long expressed a preference for uranium as a fresh surge in new nuclear power plant construction is only a matter of time, while Goldman recently has gone full-bore pushing for copper, which or course, is the key component of electrical transmission (see the following note from Goldman S&T "Turning Copper into Gold" available to professional subs).

20% Other utilities: regulated utilities appear less interesting at first, but increased power demand should benefit them through new contracts. In a regulated energy market, local utility companies control a monopoly. Customers in these markets have no choice but to purchase their energy from the local utility, and these companies produce, sell, and distribute energy to the community. We picked the regulated utilities we have highest conviction in.

In case it is still unclear, the common driver behind these investment themes is one: staggering demand for electricity. According to US electricity forecasts, the US load growth is expected to be 5x higher in 2028 vs today. This is already impacting the Power Up America basket’s earnings expectations: 2024 & 2025 net income estimates have been consistently revised up. Notably, 2024 net income expectations are up ~10% since Jan-2023, and next year’s earnings are expected to be an additional 10% higher than this year end. Expect many more such upward revisions.

Another reason why it is now to turn attention toward the Power aspect of the AI revolution is that while the impact of AI has led to increase in valuations of data center equipment, the impact in valuations to power have been disproportionately lower, even though the power angle is also a beneficiary of the same trends. Expect a powerful valuation "catch-up" in the coming days as attention shifts away from core AI beneficiaries, and Data Center Equipment, toward "Power Up America."

Below we break down the individual components of the Power Up America basket:

Next, we highlight several of the companies which have stood out in recent Goldman research and earnings calls:

1. Smart-grid infrastructure

Emcor Group EME: Comments from the last earnings call highlight their "network and communications business unit, which includes hyperscale data center work, stands at almost $1.6 billion, up 59% from December 2022 […] This requires power, putting this into perspective, if you look at an office building, or even a hospital complex, that consume between 5 to 10 megawatts, data centers are multiples higher".

Quanta Services PWR: GS research continues to see "strong secular growth which we believe PWR will be a primary beneficiary of given its customer relationships with utility companies of which we estimate is 67% of its customer base. In 2024, research estimates 13% YoY revenue growth in electric power and renewable energy, on a combined basis. Per management commentary, we see significant growth opportunities on the transmission side where we believe energy transition efforts and historical under-investment will support demand. As such, research expects to see continued momentum in PWR’s backlog as additional large projects are undertaken across the industry".

General Electric GE: "The bottom line is that it is hard to not come away encouraged by the progress this management team has already made in turning around this business and the opportunity that lies ahead. Specifically, GE Vernova is at the nexus of the Electrification and Decarbonization trends that are going to shape the next decade of investment and there is also plenty of self-help to drive material performance improvement regardless of the growth backdrop".

Comfort Systems FIX: Comments from the last earnings call highlight "revenue driven from technology markets went from 13% to 21%, and it is overwhelmingly data centers. Data centers keep getting bigger in Texas, Virginia, and across the country".

Atkore ATKR: Comments from the last earnings call highlight "the electrical industry is a great place to be. It's difficult to find a building or infrastructure project that does not require Atkore's products. With over 90% of Atkore's product portfolio supporting electrical infrastructure, we are well positioned to benefit from the strong electrical trends projected across numerous end market categories […] First, Q1 was a solid start to year with organic volumes up 13%. Second, the declaration of our first quarterly dividend is another recognition of our structural improvements and transformation over the past several years. Third, with a great team, product portfolio, and strategy supported by strong secular tailwinds, we believe the best is yet to come at Atkore".

2. Unregulated Utilities

Constellation Energy CEG: Comments from the last earnings call highlight "the demand coming from data economy: “BCG believe that AI and regular data center demand will grow by 7% to 10% of total electricity demand by 2030. To put this in context, this is the equivalent of the electricity used for lighting in every home, business, and factory across the US. It is a huge amount of energy. Most traditional data centers that were built 10 years ago were 10 megawatts or less. It is not uncommon to see 100-megawatt data centers. And with our clients, we’re talking about data centers that approach 1000 megawatts, 24/7. That is something that doesn’t get talked about enough in my opinion”.

Vistra Corp VST: Comments from the last earnings call highlight: “the grids have become a little bit tighter across the country, we’re seeing the fossil assets retire, particularly coal. And then we’re seeing more electrification. We’re seeing customers approach us at a rate that we haven’t seen in my history with this industry. And data centers, specifically, they’re looking for speed to martket. So they’re trying to get online as fast as they can […] Whether that load goes behind-the-meter or out on the grid, it's new demand. And that's part of this supply-demand equation that might also send the price signals. That could also then incentivize new supply […] most forecasts have a doubling of this data center load by 2030. Texas, which is already the second-largest data center market in the country, may end up getting a disproportionate amount of it".

3. Power-Generating Materials

Freeport-McMoRan FCX: Comments from last earnings call highlight "there are other factors related to global growth, connectivity, these data centers, and some of that's being driven by artificial intelligence. Just everywhere you turn, the world is getting more electrified, and that's why I think the fundamental long-term demand thesis for copper is just getting stronger and stronger".

4. Other Utilities

NextEra Energy NEE: "has seen higher load as a result of data centers and manufacturing, which it believes has surprised the market in terms of magnitude. In order to support this growing load, NEE believes siting has become even more important, with development cycles extending to ~5-7 years".

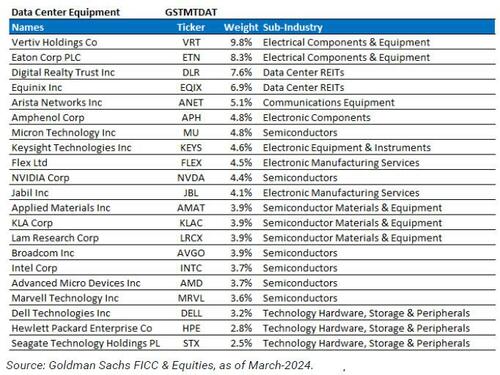

Finally, for those who still believe that Data Center Equipment will continue to outperform, here is a breakdown of the companies that comprise that basket:

The punchline on the Power Up America investment theme , as Goldman's Louis Miller writes in a recent Thematic Basket note (available to pro subs here), is that "focus across the AI stack has shifted from software and AI tools to the hardware angle, where there could be less of a winner takes all dynamic and many of the incumbents in the market have the potential to capitalize on AI advancements. As a result, we expect the hardware and power oriented industries to catch up to the broader AI theme."

Not only that, but as explained above, even if AI ends up being a giant dud in the end - and it very well might - that particular outcome is years if not decades away, and meanwhile "the hardware and power companies will win in the near term regardless of whether or not the software companies successfully introduce their AI product."

Furthermore, as noted above, for those with a commodity bent, Copper is also starting to show signs of what Goldman has called "AI exposure" considering it is an essential material to produce power. And once the narrative shifts and conventional wisdom starts equating copper not with the moribund Chinese economy but with the "AI revolution", watch out above (for much more read Turning Copper into Gold, available to professional subscribers).

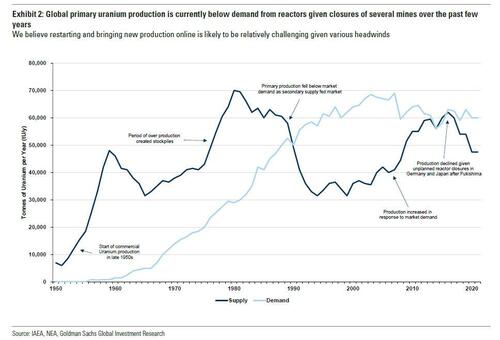

And then there is our favorite commodity (next to oil): uranium, which we believe will benefit just as much as copper from the transition of the AI theme to the various derivative plays. Not surprisingly, one day after we asked our readers if they "got uranium" in the context of the coming electricity demand deluge...

got uranium? pic.twitter.com/kK8ENvrUbg

— zerohedge (@zerohedge) March 31, 2024

... Goldman published an initiating coverage report (with a Buy rating) on one of the core uranium pillars of the Power Up America basket (and a name that is quite familiar to regular Zerohedge readers, one we have been praising since 2020): Cameco Energy, aka CCJ, and which Goldman believes "provides investors with an attractive means to gain exposure to the entire Uranium/Nuclear fuel value chain in an environment where increased demand and higher prices should lead to meaningful estimate revisions by consensus. We believe that prices are likely to average US$95/lb (spot) and ~US$68/lbs (realized price for CCJ) over the next several years on a normalized basis. This is ~170%/~65% higher than the historical figures (2013-2023 average), which we believe is supported by a combination of meaningful supply deficit and a miscalibration of enrichment requirement assumptions that is potentially understating demand."

The thesis here is simple: Uranium demand is about to explode and there is nowhere near enough supply, and of course there is much more in the full CCJ initiating coverage note available to pro subscribers in the usual place.

Finally, for those who would rather stick to the safety of the Data Center Investment theme, we have you covered too, with a brief, if clutch UBS note on Data Center FAQ.

Much more available to professional subs including: