NS

NSNVDA -6.9% after-market, European futures indicate a softer open - Newsquawk Europe Market Open

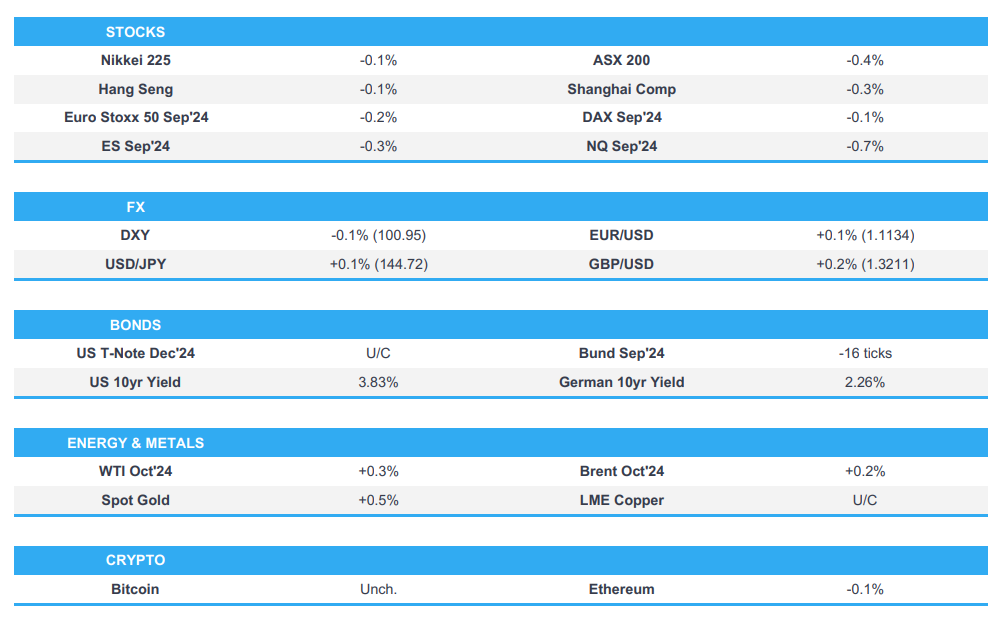

- APAC stocks traded with modest losses across the board following the weak lead from Wall Street and in the aftermath of NVIDIA's ill-received earnings.

- NVIDIA settled -6.9 % after-market despite solid earnings and a USD 50bln share buyback, some suggested disappointment as metrics fell short of the highest forecasts.

- NZD was boosted after ANZ Business Outlook soared whilst JGB futures saw upticks on a well-received 2-year JGB auction.

- European equity futures are indicative of a softer open with the Euro Stoxx 50 future -0.2% after cash closed higher by 0.3% on Wednesday.

- Looking ahead, highlights include Spanish CPI, German CPI, EZ Sentiment, US PCE (Q2), GDP (Q2), IJC, ECB’s Rehn, Lane; Fed’s Bostic, Supply from Italy, US, and Earnings from Lulelemon, Dollar General, Best Buy, Marvell

More Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed lower but off worst levels, with the weakness into the close led by the Nasdaq and semiconductor names ahead of Nvidia (NVDA) earnings.

- After the close, as NVIDIA earnings were released, ES and NQ futures saw initial two-way action before moving lower as NVIDIA shares swung between gains and losses before eventually slipping deeper into the red (-10% at worst vs +2% at best), despite overall solid metrics and an additional USD 50bln buyback. NVIDIA settled -6.9% after-market, some suggested disappointment as earnings and guidance fell short of the highest forecasts to justify valuations.

- SPX -0.60% at 5,592, NDX -1.18% at 19,350, DJIA -0.39% at 41,091, RUT -0.57% at 2,190.

- Click here for a detailed summary.

US EARNINGS

- NVIDIA Corp (NVDA) Q2 2025 (USD): Adj. EPS 0.68 (exp. 0.64), Revenue 30.04bln (exp. 28.68bln); approved an additional USD 50bln in share buyback and maintained quarterly dividend at 0.01/shr. Revenue Breakdown: Data centre 26.3bln (exp. 25.08bln). Professional Visualization 454mln (exp. 451.1mln). Automotive 346mln (exp. 347.9mln). Gaming 2.9bln (exp. 2.79bln). Full earnings available here. EARNINGS CALL: Q2 gross margins negatively impacted by inventory provisions for low-yielding Blackwell material and may continue to be impacted in future. Notable commentary available here. Shares fell 6.9% after-hours; desks suggest disappointment amid a lack of a "mega-beat".

- Salesforce Inc (CRM) Q2 2024 (USD): Adj. EPS 2.56 (exp. 2.36), Revenue 9.33bln (exp. 9.23bln); President and CFO Amy Weaver to step down. Shares rose 4.1% after-market.

NOTABLE HEADLINES

- Apple (AAPL) reportedly orders over 10% more of its first AI-equipped iPhones vs last year, according to Nikkei sources; told suppliers to prepare for 88-90mln iPhones (vs initial order for ~80mln iPhones).

- OpenAI is in talks for a funding round valuing it over USD 100bln with Microsoft (MSFT) also expected to put its money, according to WSJ.

- Fed's Bostic (2024 voter) said there is still a distance to go on inflation, while the labour market is quite strong by historical standards, according to Reuters. He repeated that he is still awaiting data to be sure it's time to cut rates. He noted inflation has come down faster than expected, unemployment has risen further than he thought. He noted the Fed can not wait till inflation is at 2% to move away from a restrictive stance - "This means we should pull forward rate cut to 3rd quarter". He warned it would not be good to cut rates only to have to raise them again.

- WSJ's Timiraos, in reference to Discount rate minutes, said "On Tuesday, the minutes for the July discount rate meetings showed that the boards of the Chicago Fed and New York Fed proposed setting the discount rate at a level 25 bps lower than where it has been all year. Some commentators inferred that this meant the New York Fed president must have supported a lower fed-funds rate in July."

- US Supreme Court declined to revive Biden administration's student debt relief plan, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks traded mostly with modest losses following the weak lead from Wall Street and in the aftermath of NVIDIA's ill-received earnings. The tech sector was among the laggards in the region with Samsung Electronics (005930 KS), Tokyo Electron (8035 JT), and TSMC (2330 TT) all opening lower by 2-3%.

- ASX 200 was subdued amid the broader market mood and with Australia's earnings season picking up in pace. Materials, Energy and Tech resided as some of the lagging sectors.

- Nikkei 225 briefly dipped under USD 38k in early trade, with Japanese activity also affected by the approaching Typhoon Shanshan, although the index eventually eked mild gains amid gains in Industrial names.

- Hang Seng and Shanghai Comp both conformed to the APAC mood and later extended their losses, whilst earnings season in Hong Kong saw Meituan jump almost 10% while Li Autos slid 10.6%.

- US equity futures were mixed with the ES (-0.3%) and NQ (-0.7%) lower amid NVIDIA slumping almost 7% after its earnings and conference call. YM (+0.3%) and RTY (+0.4%) traded with modest gains throughout the APAC session.

- European equity futures are indicative of a softer open with the Euro Stoxx 50 future -0.2% after cash closed higher by 0.3% on Wednesday.

FX

- DXY was relatively uneventful with a downward bias, and within narrow ranges in what was seemingly more of a consolidation after the prior day's rise. Little reaction was seen to commentary from Fed's Bostic overnight at a moderated Q&A as he reiterated comments from recent speeches. DXY traded in a 100.91-101.02 range, within Wednesday's 100.59-101.17 parameter.

- EUR/USD was marginally firmer amid the modestly softer Dollar in early APAC trade, with the pair attempting to recoup losses after printing a 1.1104 low yesterday. EUR/USD traded in a 1.1117-37 range.

- GBP/USD saw some momentum after the pair mounted 1.3200 to the upside to print a 1.3214 APAC peak. Cable thereafter oscillated around the round figure.

- USD/JPY was steady and largely moved in tandem with the USD amidst the absence of newsflow in another quiet summer session. USD/JPY traded between 144.23-79.

- Antipodeans were both firmer to varying degrees. NZD outpaced peers following the ANZ data which showed NZ business confidence soaring. NZD/USD reached a 0.6294 high whilst AUD was later hindered by the AUD/NZD cross approaching 1.0800 to the downside.

- PBoC set USD/CNY mid-point at 7.1299 vs exp. 7.1297 (prev. 7.1216)

FIXED INCOME

- 10-year UST futures saw flat trade in a quiet APAC session and after settling lower by half a tick on Wednesday, while the 5-year auction tailed was well received compared to recent auctions.

- Bund futures traded on either side of 134.00 in a narrow 133.95-134.04 range and within yesterday's 133.89-134.39 parameter.

- 10-year JGB futures were flat for most of the session but saw a fleeting uptick after Japan's 2-year JGB auction saw the strongest demand ratio in two years.

- US sells USD 70bln of 5yr notes; High Yield: 3.645% (prev. 4.121%, six-auction average 4.370%). WI: 3.642%. Tail: 0.3bps (prev. 1.1bps, six-auction avg. 0.4bps). Bid-to-Cover: 2.41x (prev. 2.4x, six-auction avg. 2.38x). Dealers: 13.2% (prev. 14.0%, six-auction avg. 15.2%). Directs: 16.3% (prev. 18.8%, six-auction avg. 17.9%). Indirects: 70.5% (prev. 67.2%, six-auction avg. 66.8%).

COMMODITIES

- Crude futures moved sideways the prior session's selling with newsflow quiet overnight and amidst a lack of geopolitical escalation.

- Spot gold was modestly firmer but uneventful amid a lack of catalysts, with the yellow metal testing resistance at USD 2,515/oz throughout the session.

- Copper futures were subdued and reflective of the broader APAC sentiment, although 3M LME copper remained in a tight parameter.

- Argentinian mining secretary said mining exports to double to USD 10bln in 2027 from USD 4bln this year on lithium and copper, according to Reuters.

- South32 (S32 AT) expects to see improvement in aluminium prices on USD weakness and China buying, according to Reuters.

CRYPTO

- Bitcoin traded horizontally on either side of USD 59k.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 150.9bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- South Korean President Yoon said the government will introduce an automatic stabilization tool for the long-term sustainability of pension fund and is to raise the basic monthly pension by KRW 400k within his term, according to Reuters.

DATA RECAP

- New Zealand ANZ Business Outlook (Aug) 50.6% (Prev. 27.1%)

- New Zealand ANZ Own Activity (Aug) 37.1% (Prev. 16.3%)

- Australian Capital Expenditure (Q2) -2.2% vs. Exp. 1.0% (Prev. 1.0%)

- Australian Plant/Machinery Capex (Q2) -0.5% (Prev. 3.3%)

- Australian Building Capex (Q2) -3.8% (Prev. -0.9%)

GEOPOLITICS

- No notable updates.

EU/UK

NOTABLE HEADLINES

- Italy plans to confirm commitment to bring deficit-to-GDP ratio below EU's 3% ceiling in 2026 in upcoming medium-term structural budget plan, according to Reuters sources

DATA RECAP

LATAM

- Brazilian President Lula nominated BCB Director Galipolo as the Brazil Central Bank chief, according to Reuters.

- Mexico Lawmaker Monreal said Judicial reform is to be debated in the lower house in the first week of September, according to Reuters.