NVDA Options Into Earnings

Hedge NVDA

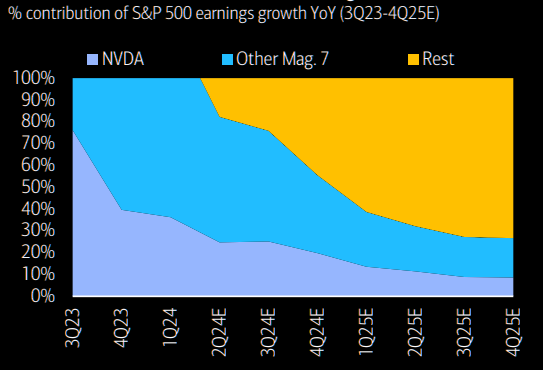

BofA outlines the logic for hedging NVDA downside with SPY put spreads: "NVDA results have been a key driver of equity indices, and investors may be underpricing the risk of a disappointment. We think S&P put spreads offer better protection than NVDA-based hedges against this risk and its impact on the broader market (e.g. SPY 6-Sep 555-545 put spreads for over 5x max payout)".