NS

NSUS stocks saw late selling whilst NVIDIA closed lower by over 6% - Newsquawk Asia-Pac Market Open

- US stocks were gradually bid throughout the majority of the session despite the weaker NVDA shares post-earnings, although stocks later fell off highs.

- The Dollar Index rose above the 101 handle, with earlier gains in the session kickstarted by Euro Weakness rather than dollar-specific drivers.

- T-notes faded European strength on upward GDP revision and inline Jobless Claims data.

- The crude complex was firmer on Thursday, albeit settling off highs, after further Libya updates and initial Iraq-induced upside usurped Dollar strength or any lack of Middle Eastern updates.

- Looking ahead, highlights include South Korean Output data, Japanese Tokyo CPI, Australian Bond Auction, Japanese Retail Sales Australian Retail Sales.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were gradually bid throughout the majority of the session despite the weaker NVDA shares post-earnings. However, a late trade tech sell-off saw these gains unwind with NVDA extending on losses while some of the large-cap names propping up the indices earlier (TSLA, GOOGL, MSFT) fell off highs.

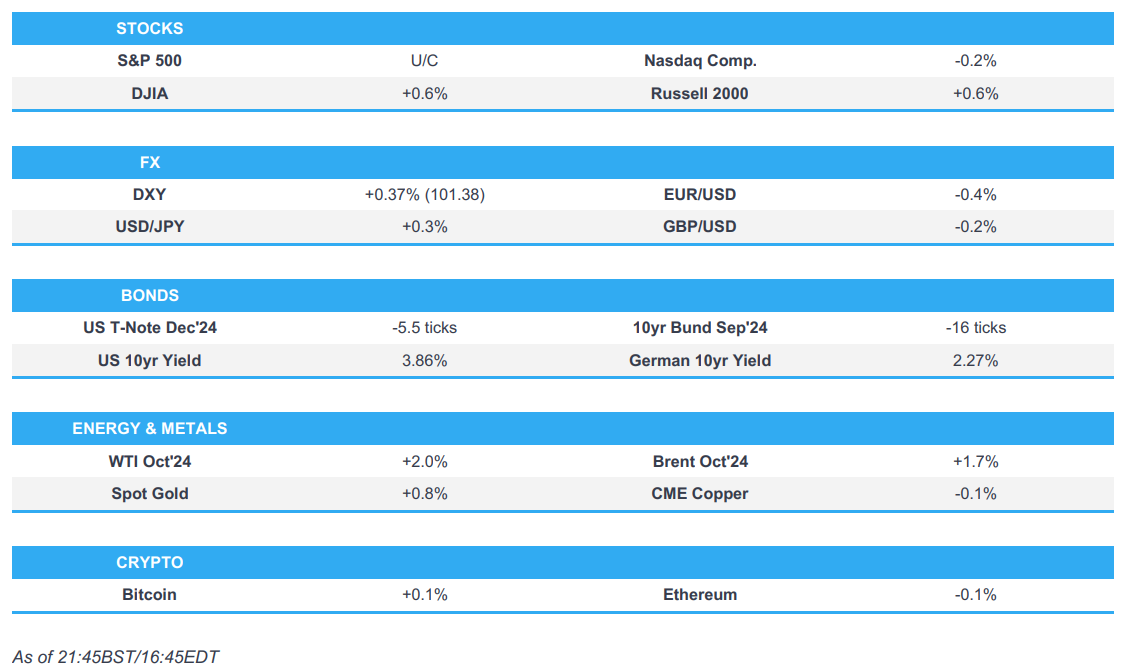

- SPX flat at 5,592, NDX -0.13% at 19,325, DJIA +0.59% at 41,335, RUT +0.66% at 2,203

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fitch affirms USA at AA+; Outlook stable.

FX

- The Dollar Index rose above the 101 handle, with earlier gains in the session kickstarted by Euro Weakness rather than dollar-specific drivers.

- G10 FX price action was mixed, with upside against the buck present in Antipodes and the CAD, while CHF, JPY, GBP, SEK, and JPY were all in the red.

- The Euro saw weakness versus the greenback on Wednesday, with losses arising after the German state CPI cooled more from the prior than was anticipated.

- Haven FX weakened on the day, suffering from a stronger buck and US yields rather than currency-specific drivers.

- EM FX performance was mixed for the day, with outperformance present in ILS, KRW, and the CLP, although the upside was modest.

FIXED INCOME

- T-notes fade European strength on upward GDP revision and inline Jobless Claims data.

COMMODITIES

- The crude complex was firmer on Thursday, albeit settling off highs, after further Libya updates and initial Iraq-induced upside usurped Dollar strength or any lack of Middle Eastern updates.

- South32 (S32 AT) expects to see improvement in aluminium prices on USD weakness and China buying, according to Reuters.

- Russian gov't has announced that fuel and oil production numbers are to be a state secret, via KyivPost.

- Libya's Waha Oil Co. production has dropped to 150k BPD, expected to decrease further, via Reuters citing engineers.

- Iraq's Oil Exports (Jul.): To average 3.48mln BPD (prev. 4.3mln in June), via Oil Ministry

- JPMorgan forecasts nickel prices to average USD 18.5k/MT in Q4 '24, rising to USD 19.8k/MT over 2025.

- Iraq plans to cut oil output to between 3.85-3.9mln BPD in September, according to sources.

- Libyan oil crescent ports halt export operations on Thursday, via Reuters citing engineers.

- US EIA- Nat Gas, Change Bcf w/e 35.0bcf vs. Exp. 38.0bcf (Prev. 35.0bcf)

CENTRAL BANKS

- Fed's Barkin (2024 Voter) says inflation is down, not there yet but is making progress, via Bloomberg citing local radio.

- ECB's Holzmann says "It's not that I'm against lowering rates, but one has to be careful, or one could be forced to take a step back", "Hopefully we'll have more positive information by September 12th", via Econostream. Click for full comments.

- ECB's Nagel says while our 2 % target is in sight, we have not reached itThere is a risk somewhat stronger economic recovery could further delay the target return. Timely return to price stability cannot be taken for granted. ECB needs to be careful, and must not lower policy rates too quickly.

- SNB's Jordan says the mandate of the SNB is to maintain price stability, a crucial precondition for society and a good functioning country. SNB reacted early to the recent inflation rise, this kept inflation under control. The weak Euro area is hurting demand for Swiss exports. The exchange rate makes the situation difficult for Swiss industry, whose already dealing with weak demand in Europe.

- REUTERS POLL: BoC expected to cut rates to 4.25% on September 5th; rates seen ending 2024 at 3.75% according to 20 of the 28 surveyed, while 7 see 4.00% and 1 sees 3.50%.

GEOPOLITICAL

- US NSA Sullivan said Gaza talks have now moved to an advanced stage, and added talks have made progress but many issues remain unresolved, via Asharqnews/Al Arabiya.

- China's Commerce Ministry said it will not impose provisional anti-dumping subsidy on brandy imported from the EU.

- US official said the US sees a limited opportunity to restart nuclear policy dialogue with China; the US seeks arms talks with China focused on nuclear doctrine, strategic warning, and risk reduction.

- Netherlands to put more curbs on ASML's (ASML NA) China chip business, according to Bloomberg.

DATA

- US Initial Jobless Claims 231.0k vs. Exp. 232.0k (Prev. 232.0k, Rev. 233k)

- US Continued Jobless Claims 1.868M vs. Exp. 1.87M (Prev. 1.863M, Rev. 1.855M)

- US GDP 2nd Estimate (Q2) 3.0% vs. Exp. 2.8% (Prev. 2.8%)

- US GDP Sales Prelim (Q2) 2.2% vs. Exp. 2.1% (Prev. 2.0%)

- US GDP Deflator Prelim (Q2) 2.5% vs. Exp. 2.3% (Prev. 2.3%)

- US PCE Prices Prelim (Q2) 2.5% (Prev. 2.6%)

- US Core PCE Prices Prelim (Q2) 2.8% vs. Exp. 2.9% (Prev. 2.9%)

- US Adv Goods Trade Balance (Jul) -102.66B (Prev. -96.56B)

- US Wholesale Inventories Adv (Jul) 0.3% (Prev. 0.2%, Rev. 0.1%)

- US Pending Sales Change MM (Jul) -5.5% vs. Exp. 0.4% (Prev. 4.8%)

- US Pending Homes Index (Jul) 70.2 (Prev. 74.3)

ASIA-PAC

NOTABLE HEADLINES

- PBoC will step up counter-cyclical adjustments; will strengthen financial support to the real economy.

- Nippon Steel (5401 JT) Vice Chair Mori says rivals are lobbying the Japanese government to consider measures to curb China steel imports. Says he met with Democratic VP Nominee Tim Walz in June and discussed the US steel deal. Will visit the US again next month. Nippon Steel sticks to the plan to close US Steel (X) acquisition by the end of 2024. Nippon Steel may buy more interest in the coking coal mine.

- Taiwanese PC Maker Acer (2353 TW) plans to sharply increase shipments of computers equipped with AI features; will raise the share of copilot+ pcs among deliveries to 40% by Q3 25, via Nikkei.

DATA

- German HICP Prelim YY (Aug) 2.0% vs. Exp. 2.3% (Prev. 2.6%); Core 2.8% (prev. 2.9%)

- German HICP Prelim MM (Aug) -0.2% (Prev. 0.5%)

- German CPI Prelim YY (Aug) 1.9% vs. Exp. 2.1% (Prev. 2.3%)

- German CPI Prelim MM (Aug) -0.1% vs. Exp. 0.1% (Prev. 0.3%)

- German Bavaria State CPI MM (Aug) -0.1% (Prev. 0.3%); CPI YY (Aug) 2.1% (Prev. 2.5%); the regional metrics were generally cooler than prior/mainland implied set of data, pressuring EUR & rallying EGBs. Mainland figures due at 13:00 BST / 08:00 EDT

- German North Rhine-Westphalia State CPI YY (Aug) 1.7% (Prev. 2.3%); Core 2.5% (prev. 2.8%); MM (Aug) -0.1% (Prev. 0.3%)

- EU Business Climate (Aug) -0.62 (Prev. -0.61); Cons Infl Expec (Aug) 11.3 (Prev. 11.2); Selling Price Expec (Aug) 6.1 (Prev. 6.8); Services Sentiment (Aug) 6.3 vs. Exp. 5.2 (Prev. 4.8); Economic Sentiment (Aug) 96.6 vs. Exp. 95.8 (Prev. 95.8); Industrial Sentiment (Aug) -9.7 vs. Exp. -10.6 (Prev. -10.5); Consumer Confid. Final (Aug) -13.5 vs. Exp. -13.4 (Prev. -13.4)

- Spanish CPI YY Flash NSA (Aug) 2.2% vs. Exp. 2.40% (Prev. 2.80%); Core 2.7% vs Exp. 2.6% (prev. 2.8%)

- Swedish GDP Final QQ (Q2) -0.3% vs. Exp. -0.8% (Prev. -0.8%); GDP Final YY (Q2) 0.5% vs Exp. 0.0% (prev. 0.0%)

- Swedish Overall Sentiment (Aug) 94.7 (Prev. 95.0