NS

NSUS stocks were sold on Monday with the overnight upside in futures pared once cash trade began - Newsquawk Asia-Pac Market Open

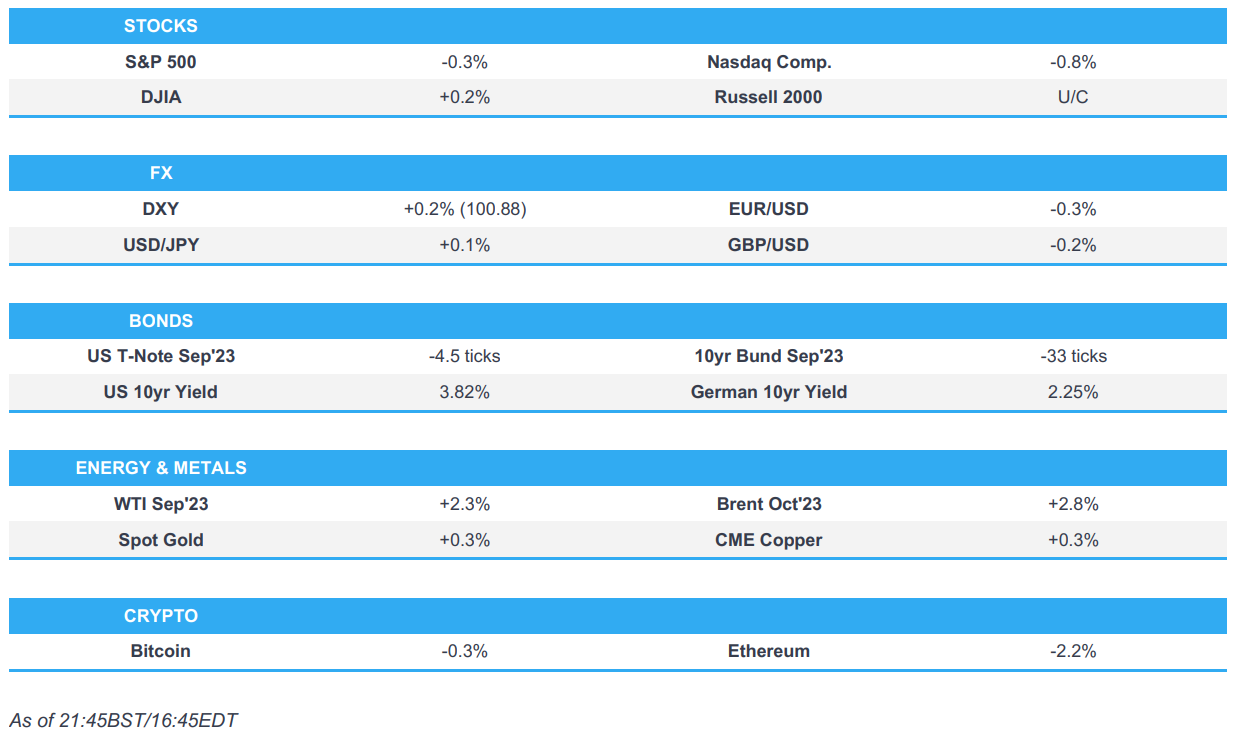

- US stocks were sold on Monday with the overnight upside in futures pared once cash trade began. The losses were mixed, however, with the downside felt mostly in the Nasdaq.

- The Dollar attempted to recoup some of last week’s heavy selling, with Friday’s weakness induced by a dovish Powell.

- T-Notes sold off across the curve with the curve bear steepening in a choppy session.

- The crude complex saw notable gains to start the week as heightened Middle East tensions were later accentuated by Libya updates.

- Looking ahead, highlights include UK BRC Shop Price Index, Japanese Corporate Services Price Index, Chinese Industrial Profits, and BoJ Core CPI.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were sold on Monday with the overnight upside in futures pared once cash trade began. The losses were mixed, however, with the downside felt mostly in the Nasdaq with Tech, Consumer Discretionary and Health Care sectors underperforming, while Energy, Consumer Staples and Utilities outperformed.-SPX -0.31% at 5,616, NDX -1.04% at 19,516, DJIA +0.16% at 41,240, RUT +0.16% at 2,222.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Barkin (2024 Voter) says they will be taking a "test and learn" approach to rate cuts, via Bloomberg. Current low-hiring, low-firing approach companies are taking to employment is unlikely to persist. There is a risk that firms will resort to layoffs if the economy was to weaken. Still sees upside risks for inflation, supports a dialling down of rates in the face of the cooling labour market. Believes a large part of the economy is standing ready for the easing-cycle to commence.

- Fed's Daly (2024 voter) says Fed had been on a path to lower the policy rate for a couple of months but they just needed a bit more confidence inflation was returning to target; Labour market is in complete balance, time to adjust policy is upon us. Not hearing signs that firms are poised for layoffs. Direction of rates is down, but it is too early to know how big rate cuts will be. Does not want to declare they are on the path to neutral.

- Apple (AAPL) announced iPhone event for September 9th, via CNBC.

- Apple (AAPL) announced Kevan Parekh as new CFO; to succeed Luca Maestri effective January 1st 2025.

DATA RECAP

- US Durable Goods (Jul) 9.9% vs. Exp. 5.7% (Prev. -6.7%, Rev. -6.9%)

- US Durables Ex-Defense (Jul) 10.4% (Prev. -7.2%, Rev. -7.5%)

- US Durables Ex-Transport (Jul) -0.2% vs. Exp. -0.1% (Prev. 0.4%, Rev. 0.1%)

- US Nondefe Cap Ex-Air (Jul) -0.1% (Prev. 0.9%, Rev. 0.5%)

FX

- The Dollar attempted to recoup some of last week’s heavy selling, with Friday’s weakness induced by a dovish Powell. As such, despite thin newsflow on Monday, the Buck managed to eke out gains and hit a high of 100.920, vs. last week's low of 100.60 and high of 102.46.

- CAD was the clear G10 outperformer and the only currency to see gains against the Dollar as it was buoyed by the crude complex strength, as opposed to anything Loonie-specific.

- NZD, EUR, AUD, JPY, and GBP all saw weakness, albeit to varying degrees, and it was a function of broader Dollar strength as opposed to anything currency-specific.

- CHF was flat vs. the Buck and seemed to gain traction and appeal as a result of the weekend’s geopolitical escalation. Nonetheless, the cross was still in a pretty tight range, indicated by a peak of 0.8485 and a trough of 0.8457.

- EMFX was mixed, and without sounding like a broken record, in light trading conditions. ZAR and CLP were aided by firmer spot gold and copper prices, respectively, while MXN recouped some of last week’s selling.

FIXED INCOME

- T-Notes sold off across the curve with the curve bear steepening in a choppy session. T-Notes initially continued the Friday dovish Powell bid to peak at 113-30 overnight before paring as the US session began, perhaps linked to the upside in oil prices after Libya announced it will stop all oil production and exports. There was a notable bid back up to the peaks in response to remarks from Fed's Barkin in a Bloomberg podcast. Nonetheless, the post-Barkin upside was short-lived with T-Notes quickly falling to session lows of 113-19. IFR highlighted that a chunky 10yr October put buyer was the reason, with market makers having to sell September 10yr futures as a hedge. Nonetheless, the move then pared before being sold yet again to see T-notes settle at lows.

COMMODITIES

- The crude complex saw notable gains to start the week as heightened Middle East tensions were later accentuated by Libya updates.

- Russia's (441k BPD) Omsk oil refinery has reported a fire, which has been brought under control; plant is working as usual.

- Russia says it hit three gas stations in three regions in Ukraine, via Asharq News; says it targeted Western-supplied weapons at airports in Ukraine, via Sky News Arabia.

- Libya's eastern gov't says it will be stopping all oil production and export, via Bloomberg.

- A fire broke out in the Leuna Chemical Park in the eastern German state of Saxony-Anhalt on Monday morning; Linde (LIN) operates the company's largest gas centre in Leuna, producing hydrogen, oxygen, nitrogen, carbon monoxide and other speciality gases.

- US seeks about 3.6mln of oil to help replenish SPR for delivery in January through March next year.

GEOPOLITICAL

- Iranian Foreign Minister says that the nation's response to Israel will be "definite, calculated and accurate", according to a statement.

- Iranian official says revenge against the Israeli entity is inevitable, according to Sky News Arabia; assassination of Haniyeh in Tehran is unforgettable and revenge for his blood by the axis of resistance or by Iran is inevitable.

- There is concern in Washington that Iran may become directly involved in the conflict, but an Iranian attack does not appear imminent, according to WSJ quoting an American official; have no plans to change the enhanced US military presence in the region.

- Explosions hears in Kyiv, Ukraine, via Reuters witnesses.

- Japan Defence Ministry says has scrambled jets against Chinese military aircraft.

- Russian Kremlin says there have been no ceasefire discussions with Ukraine; topic of negotiations has "pretty much lost its relevance".

- Germany received a tip-off from foreign intelligence services on a potential act of sabotage by Russia at a NATO site, according to NTV.

- Canada is set to impose new tariffs on Chinese EVs, steel, and aluminum, according to Bloomberg.

- Jordan, Egypt and the Palestinian Authority are not satisfied with the new Israeli conditions for concluding an agreement on Gaza, according to Sky News Arabia citing sources.

ASIA-PAC

NOTABLE HEADLINES

EU/UK

NOTABLE HEADLINES

- Riksbank Minutes: Overall, the minutes highlight that while a 50bps move was considered/discussed the preference among the board was for 25bps with various factors as to why a larger magnitude would not be appropriate. However, the language makes clear that nothing is ruled out ahead and the preference from the governor is for a cut to occur at each meeting in H2 (in-line with the most dovish end of the new verbal guidance from August). Full details on the headline feed

- EUROPEAN CLOSES: Euro Stoxx 50 -0.26% at 4,897, DAX -0.06% at 18,622, CAC 40 +0.18% at 7,590, SMI +0.10% at 12,359, FTSE MIB -0.13% at 33,605, IBEX 35 -0.11% at 11,266, PSI +0.26% at 6,716, AEX -0.12% at 907.

DATA RECAP

- German Ifo Business Climate New (Aug) 86.6 vs. Exp. 86.0 (Prev. 87.0); Current Conditions 86.5 vs. Exp. 86.5 (Prev. 87.1); Expectations 86.8 vs. Exp. 86.5 (Prev. 86.9, Rev. 87.0)

- Belgian Leading Indicator (Aug) -12.6 (Prev. -12.3)